PART VI: SOME CANOPY FRUIT + RED PILLS + GOLD NUGGETS

RAPID-FIRE WISDOM TO LIVE, WORK, AND PLAY BY

An inverted 100-year gold chart is the 100 US Dollar chart in real terms. Dollars are fiat, and the entire global economic system is also debt-based and fiat. When an asset class becomes very cheap, you should probably buy it. Cash is trash.

"Gold is money, everything else is just credit." —JP Morgan

Sound money is:

- Portable (USD, Gold, Bitcoin)

- Fungible (USD, Gold, Bitcoin)

- Divisible (USD, Gold, Bitcoin)

- Scarce (Gold, Bitcoin)

- Tangible (Gold)

- Indestructible (Gold)

- Useful (Gold)

The USD does not check enough boxes to be considered sound money, making it just a shite currency. Gold meets all of these criteria, thus is the gold standard for sound money, but where bitcoin lacks in some areas, it's more convenient than gold in others such as portability. I like gold, then bitcoin, then fiat, trash currency in that order as far as mediums of exchange are concerned. Gold and bitcoin are money, dollars and alt coins are currencies.

1oz of gold is always worth the same, it got you a nice tunic in Rome, and a nice suit today. Its price is only volatile because its price in USD mirrors expansions in the credit supply. Leaving the Gold Standard in 1971 was the best thing for its price, nominally speaking, but its intrinsic value has never changed.

Gold is only created when a star goes super nova, or 2 neutron stars collide. Gold is God's money, Bitcoin is man's money. Dollars are fiat trash.

If someone says gold is just a stupid metal, they are wrong because it's actually the best metal. Gold doesn't corrode, is stable, malleable, highly conductive, among other things. If gold were more common, we'd use it in everything. We just decided it makes perfect money for Earth, because it's portable, fungible, divisible, scarce, tangible, indestructible, and useful.

If dollars are fiat trash, then what gives them any value? 90% of global trade is denominated in USD, it remains the world reserve currency, has petro dollar status, and comes with a monopoly on the use of physical force. The dollar sits on top of the entire fiat global ponzi scheme.

People keep waiting for interest rates to start rising again in the US, but Japan's interest rates went negative in 2008 and haven't been positive since. 1/3 of Europe is experimenting with negative rates, and borrowers in Denmark can even get paid for taking on a negative mortgage for a home.

The Fed is in a rate trap right now.

Australia just ended the longest bull market in world history from the onset of the virus.

Sustained low interest rates probably do more harm than good for an economy.

Fed "tools" that all pretty much mean the same thing: more debt

- POMO: Permanent Open Market Operations

- QE: Quantitative Easing: Counterfeit money used to buy T bonds/Mortgage-backed securities

- Not QE: Quantitative Easing, nice try!

- Operation Twist: sounds fun

- ZIRP: Zero Interest Rate Policy

- Repo Market

- Corporate Debt Purchase (sounds faschy)

- Talking about wanting to be able to buy stocks (even fashcy-er)

- Buying stocks using BlackRock as a "revolving door" intermediary anyway (fascismo!)

The "Plunge Protection Team" is a real thing.

Greg Mannorino is the GOAT, baby! Check out his page Traderschoice.net

Gold and silver prices are manipulated by commercial banks and pay fines regularly.

Financial advisors don't want you to buying physical gold because if the global economic system is debt based, gold is financial anti-matter. Gold is also an asset class, as well as a benchmark they compete against, and no one likes losing to returns from "just a rock."

Gold does not get cheaper to find/mine, so avoid mining stocks completely.

Gold's scarcity is derived from it's crustal abundance. or lack thereof, and we're finding less and less large deposits with feasible grades.

We're playing the board game of Monopoly IRL.

You should never invest in gold, only buy it. Investments like stocks are based on future cash flows and ROI, whereas physical gold merely represents work that has already been completed, embodied, and stored. The work is done. You bought "the thing" - and there is no counterparty, and it is yours and yours alone. Stored labors that is universally accepted and easily exchangeable into any other fiat currency.

Satoshi Nakamoto is really just Alan Greenspan and a few of his closest buddies.

Gold is Catholicism and Bitcoin is the Protestant Reformation.

Andy Cuomo is just another authoritarian fascist who works for the right wing.

The Fed has been printing $2.4 Billion per hour since April 2020.

"Become your own central bank and bet against the debt."—Greg Mannarino

Trump hired Steve Mnuchin and Larry Kudlow because they both came from TV.

Larry Kudlow, Trump's Economic Advisor, has no official qualifications, lies on TV a lot, was fired from Bear Sterns for cocaine, went to rehab, now has a majestic security clearance.

John McAfee is in prison in Spain right now. He embodies the Sigma Male.

We're in a depression right now, it's just an inflationary depression, and they probably wont call it that until 2022.

The Fed couldn't print infinity dollars during the Great Depression of the 1930s, but they can this time, and most likely will.

The Fed would be wrong about half the time if they were merely incompetent, but rather, they are always wrong because they are liars and intentionally trying to mislead you.

To some, Bitcoin is a crypto currency, to others, a new payment platform like Visa. Some believe that it is the blockchain, Bitcoin's simple ledger, which will revolutionize accounting principles. More than anything though, Perimeter Monkey sees it as a set of mathematical functions attempting to free man from government-issued currencies and central bank planning. Bitcoin is an attempt to free man.

HOW QE THEORETICALLY STIMULATES AN ECONOMY, ACCORDING TO KEYNESIANS

Once an economy goes into contraction (recession or depression), the Keynesian playbook calls for central bankers to begin reducing the Federal funds rate almost immediately in order to steepen the yield curve in the bond market, as well as incentivize borrowing by financial institutions.

Think of it this way. If all other rates, including mortgages, are tied to the Federal funds rate in one way or another, consider the potential for more buyers if a 15 year fixed was only 2% as opposed to 7%. Lower debt servicing costs equate to more potential buyers being qualified, thus you can see how lowering rates is stimulative for an asset class like real estate, and can nominally inflate housing prices, as a function of lower borrowing costs.

Not only do the Keynesian central bankers believe that lowering rates stimulates a weakening economy, but they might also be inclined to paper over any toxic assets on their commercial counterpart’s balance sheets, in order to increase their strength and solvency and incentivize them to make loans to the public.

So what’s the problem? The currency the Fed uses to buy bonds and paper over commercial bank’s toxic assets is… printed out of thin air. Whenever the Fed prints money, all dollars in existence are diluted, because more currency is now chasing the same amount of goods and services.

THE VARIOUS PLAYERS IN THE RIGGED CASINO

INDIVIDUAL RETAILERS

Your dad in his home office day trading in his boxer shorts, while insisting he's a genius.

COMMERCIAL BANKS

Wells Fargo, Bank of America, Citi, JP Morgan, HSBC, etc.

INVESTMENT BANKS

Goldman Sachs, Morgan Stanley, Barclays, etc.

HEDGE FUNDS

Two buttholes managing money for 25 clients at $5 million each.

INVESTMENT ADVISORS

Edward Jones, Schwab, etc.

INSURANCE COMPANIES

State Farm, Nationwide, AIG, etc.

MUTUAL FUNDS

Vanguard, BlackRock, iShares, etc.

PENSIONS

Florida SBA, CalPERS, Teacher Retirement System of Texas, etc.

CENTRAL BANKS

The Federal Reserve, the banker's bank, here to underwrite

the entire global economy and take all yer shit.

PERIMETER MONKEYS

Just keepin' that perimeter tight.

I’m sorry, but your dad probably doesn't stand a chance. Retailers comprise of less than 30% of the poker table, play against whales with virtually unlimited buying power who also have proprietary technology used to run your dad's stop losses and fuck with his head.

GOLD IS...

- Sound money: portable, fungible, tangible, divisible, scarce, useful, and indestructible: The Gold Standard

- A store of value

- Universally pretty

- The yardstick for the entire financial system

- Not an investment (no counterparties or ROI)

- Chunks of exploded star

- Gets its color from its electrons moving over half the speed of light

- Hard to find and mine

- The end of every asset column

- A commodity

- A mirror (when priced in USD) for the amount of credit and counterparties in our debt-based global monetary system

- Hated publically by finance, but secretely hoarded

- The 4th most liquid asset on planet Earth

SILVER IS...

- Sound money: portable, fungible, tangible, divisible, scarce, useful, and indestructible

- A store of value

- Universally pretty

- Not an investment (no counterparties or ROI)

- A commodity, hard asset, affordable anonymous

- Financial anti-matter

- Misunderstood

- Gold's bipolar little brother

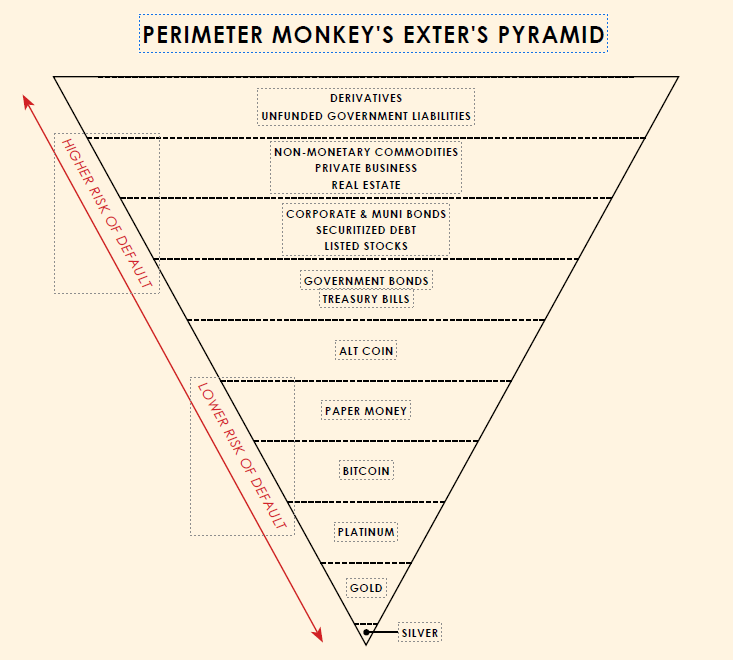

- The very tip of Exter's Pyramid

- 1oz always has been (and most likely will continue to be) worth a cooked steak

- Oddly anti-microbial and sanitary

- 12x smaller market than gold

- No counterparty risks and can't be defaulted on

- 50/50 industrial/Investment (commonly used in jewelry, dentistry, photovoltaics, electronics, as well as money)

- Not considered a tier-1 asset to banks like gold, but JP Morgan has the largest physical possesion estimated at 900 million ounces.

THE US DOLLAR IS...

- The prettiest horse in the glue factory

- The top of the fiat, global ponzi

- Backed by nothing - except for the largest, most advanced military on the planet with nearly a complete monopoly on the use of physical force... and oil

- The petro dollar - if Austrailia wants to buy oil from Indonesia, both countries must first convert their respective currencies to USD. Once the transaction is complete, any leftover USD is often used to buy US equities. Remember, oil is priced in dollars, and dollars are priced in gold

- Used in 90% of global trade

- Fiat, so like all other currencies globally, ulitimately backed by faith and printed into oblivion by corrupt and inept goverments.

SOME BARRELS OF OIL FOR YE

Back in early 2020, when oil crashed to $-40 per barrel, and I posted on FB “oil is cheaper than the water coming out of your faucet right now, get ya some of that!” I remember googling information on the various petro states to find out what kind of damage their economies would see if we didn’t see an immediate reversal. I also figured a melt down would occur in our energy sector as well, but in places like South Sudan, where oil is 96% of their export revenue, there would surely be death and destruction. Wall Street had also been over leveraged to the energy sector since they’d tried desperately to reignite it in 2016. Zionks, Scoob!

Crude is now $40 per barrel, and the danger zone is $30-40 for oil producers. However fracking costs run $42-52 per barrel, therefore the Dakotas will remain gutted until oil rises above that range.

$60-85 per barrel is the Goldilocks zone, according to the powers at be, and I believe that although the “true price” of oil should be much lower, it will in fact be much higher going forward, not from supply/demand fundamentals or any who ha like that, but because oil is priced in dollars and they can simply adjust the value of those. It’s black magic, but it will make Wall Street, oil producers, and mainly just old boomers happy, and they know what’s up. Never mind $15 per barrel oil killing millions of people in short order.

It's still a blood bath for the energy sector, but it’s been effectively put back on life support, via the Federal Reserve and other central banks coordinating and adding digits to digital screens. The difference between $1 and $1 trillion to the Federal Reserve is 12 keystrokes. 12, extremely labor intensive lifts of the finger and they can enslave entire generations while claiming they’ve saved you. They even write books about themselves like Ben Bernanke’s “the courage to print”, where he sucks his own duck and then does a book tour just in time for gen x to realize they’ve been screwed so badly they might as well become socialists.

In places like The Middle East, although they are running out of low hanging fruit, they can still produce in the $15-25 range, therefore will remain somewhat profitable in the foreseeable future.

Venezuela was and remains absolutely shafted, but that’s for many reasons, and the oil crash, ugh made their already terrifying situation worse.

Oil is a commodity and so for it actually go to zero, let alone negative, is actually insane. Put another way, if you just had an epa approved swimming pool, people wanted to come to your house, fill your pool, pay delivery, bought you pizza, and gave you $400 cash for your time, and a sonic gift card. To have oil, just to have. How could this happen? A bunch on tankers got clogged up because demand for crude fell so sharply following the shutdown; they had a tanker traffic jam. A very bad one. All of the storage on land was full, and lines of tankers kept showing up. They were desperate to get their oil offloaded. Additionally, the futures traders were paying people to take contracts off their hands. It was horrible. No one needs too much gas to sit on the couch and subsidize the airlines.

So bad that the multi billion ETF which seeks to track the price of crude, USO, broke. It was a slot machine, and if you bought the crash, odds are you are up nicely rn, with more gains very possible on the horizon, but I find it funny how fast they turned on USO. But what’s a man to do? Store barrels of oil in his garage? Sure - there are wonderful companies like XOM and BP to purchase shares of, but if you’re just trying to “safely” capture crude oil gains, USO was a highly regarded slot machine and means of doing that. Nope. A commodity traded negative, and the slot machine went temporarily out of order.

Take everything you hear from OPEC with a grain of salt. The name of the game between OPEC nations is come together, agree to production cuts, go home, and then not cut production because they need the revenue. OPEC is a cartel, and cartels sort of suck. It’s literally built into the model.

Two of the most correlated charts in economics are GDP growth and oil consumption.

THE IMPORTANCE OF THE BOND MARKET AND IT'S RELATIONSHIP TO ALL OTHER ASSET CLASSES

The Bond Market, aka the Debt Market, is the mother of all markets, and much larger than any other market (stocks, real estate, precious metals, crypto, tulip bulbs). The US bond market is bigger than the US stock market, and all-powerful global bond markets are constantly sending signals and cues to other asset classes on how to behave.

If the yield on the 10 yr US treasury were to… suddenly start spiking one afternoon… maybe in 2028 sometime… you’d be observing bond prices falling, as cash begins leaving the bond market - presumably looking for another place to go. The Bond market isn’t only the most important market to watch due to its size, but also because it’s setting the price of currency itself. I don’t need to know anything about baseball cards to have reason to believe a $250 card now might be worth $500 if the vale of the dollar were to be cut in half next year. As rates and yields fluctuate, you are really observing the price of “renting” dollars rise and fall, or put another way, the price of currency going up and down.

BOND MARKET YIELD CURVE INVERSION AS A LEADING INDICATOR FOR RECESSIONS & DEPRESSIONS

The 2 yr, 5y, 10yr and 30-year yields from the US bond market plotted on a chart represent the current yield curve. In a healthy economy, the curve should be gently slopping up. However, whenever yields for shorter-term bonds rise above yields for longer dated ones, the yield curve becomes inverted, and this has predicted a recession/depression for the last 11/8 recessions. Sometimes a yield curve can issue a false warning, but recessions always start with a 2-10 yr. yield curve inversion about 6-12 months before the recession or depression begins.

SHARE BUYBACKS, JUST ANOTHER FORM OF FINANCIAL ENGINEERING

Whenever a recession or depression begins, and after the Fed has cut rates to 0%, the CEO of JP Morgan may be inclined to borrow billions from the Federal Reserve, and then buy his/ her own stock with it. For example, if they have 100 shares outstanding, and buy 10 of their own shares with borrowed money from the Federal Reserve, there are only 90 shares left outstanding, thus reducing the available supply of shares which often causes the price of those shares to nominally move higher. If you’re a CEO whose salary is based off of share prices, why not just juice the price of those instead of borrow money for say… capital investment lol

JAPAN & EUROPE

Demographically and financially speaking, The U.S. is in many ways where Japan was in 2008. By studying Japan’s financial conditions today, we can at least get a sense of what may be in store for America’s future.

Japan started the 2008 crash at around a .5% funds rate, therefore did not have the 700 basis points (or 7%) of rate cutting available/required in order to effectively stimulate and stave off the recession.

They cut rates from .5% anyway, taking their interest rate into negative nominal territory. When this occurs, borrowers are suddenly paid to borrow, and savers and lenders are penalized. 12 years later, it hasn’t been positive since.

10 yr Mortgages in Japan today hover only around .65%, but after so many years of artificially low rates, their economy has been warped, hyper inflated asset prices, stymied real economic growth, and created a 2-tier society of “haves” and “have nots”, where housing is extremely expensive to afford, limited in supply, and simply being nominally inflated higher as a function of their dying fiat trash currency. And Japan is not alone in this. The Swiss central bank was the first to begin experimenting with Negative Interest Rate Policy in 2004 (or NIRP), and today 1/3 of Europe’s debt is serviced through negative rates.

There are also demographic similarities between the US and countries such as Japan or Switzerland as well. As growth begins to slow, and a large portion of a country’s economy begins to enter retirement and old age, this can put a severe deflationary drag on a country’s economy. Death is a deflationary act, and “more diers than buyers” in a market can really place a lot of pressure on prices. Central banks fight these forces by greatly reducing borrowing costs for their commercial counterparts, as well as adding zeros to screens and printing their respective currencies into oblivion. “Welcome my son, Welcome to The Machine.”

THIS PERIMETER MONKEY THINKS... (LET'S KEEP IT HONEST)

Interest rates need to go up, but they are heading down. Deficits are exploding at an exponential rate, but need to go down. The poor need to eat, but they are being starved out. The middle class should be strong, but has been decimated.

The rich don’t need to get richer, but that’s what negative interest rates under Trump or Biden will be for Dollar purchasing power and wages need to rise, but they were sacrificed for the boomer retirement ponzi Housing needs to become more affordable, but will become less going forward The Fed needs to stop inflating, but are printing $2.4 billion per hour and handing it to themselves.

Trump needs to level with the American people, but it’s a super V recovery and lying is always better. Biden simply needs to be able to make a sentence, but can’t. Systems and cycles need to be closed in order for the environment to heal, but we’ll pass sweeping deregulations for the zombie companies we just rolled over... again. The last credit cycle needs to deleverage, but that’s what sacrificing your labor and purchasing power is for.

We need more fiscal stimulus and less monetary, but we’ll get the opposite of that going forward. We need growth, yield, savings, interest rates, a stronger dollar, higher wages, lower asset prices- but we are doing the opposite of each of those.

There are about 15 things we could do to give our country hope, but not only are we doing none of those, they are pouring gasoline on every dumpster fire and gorging themselves.

SEMI-SAFE ASSUMPTIONS WHEN PLAYING THE GAME

There is no such thing as a bad stock (or any asset class), just bad timing.

As far as short term trading is concerned, volume (chart), price action (chart), and sentiment (how the market feeels) are your best indicators. Fundamental factors tend to take a backseat when actively trading for shorter-term capital gains.

Consider not being a contrarian when short-term trading, and always being a contrarian when investing.

The Federal Reserve couldn’t print infinity currency for the Great Depression of the 1930s, but they can this time, and most likely will.

Economics is a soft science, so you may drink the Keynesian, Austrian, or MMT Kool-Aid flavor of your choice, or even make up your own, as long as you sound smarter than the other person.

The rules to the game change as we play.

The Fed’s mandate claims to be managing/maintaining inflation and full employment, but it’s really to blow serial asset bubbles and eventually become both the lender and buyer of last resort to rule the world.

Supply/Demand, and many other fundamental indicators are often overrated. Any market may remain irrational longer than you can remain solvent.

Game theory in 2020 states “If you don’t play- you lose.”

Investors are usually just failed speculators.

If the Federal Reserve were to merge with the US treasury, and flood the entire global ponzi with dollars, while keeping rates suppressed, and using financial engineering to hyper inflate asset prices, while simultaneously keeping your wage suppressed, and stealing a decades worth of compounded interest from you, in order to prop up the stock market, to the point that you sell your gold to eat…then could that make Jerome Powell the lender and buyer of last resort… to rule to world? Could interest rates go negative next, and stay there for the next decade? How much more of the private sector will the fascists take?